Market Control Online E-invoice KSA

ERP Management System In Saudi Arabia

Looking for E-Invoicing System in Saudi Arabia?

As per Zakat, Tax and Customs Authority regulations, all taxpayers shall use tax E-Invoice systems imposed on all goods and services that are sold by businesses.

According to the regulations, the electronic invoices will be generated, stored, and amended in a full structured electronic format through an E-Invoice System, which includes all the requirements of a tax invoice and the technical aspects below:

- Cloud-based invoicing system able to integrate with ZATCA Web portal.

- Generates an electronic archive to be shared on-time with Zakat, tax, and customs authority. (PDF A3 / XML)

- Prevent tamper features is a must.

- Generates QR Code including the minimum requirements of tax invoice.

- Preferred to be scalable system with the ability to integrate with larger suite.

Enterprise resources planning system, divided into many parts and used to link between all organization departments and factories.

The know-how of profit margin growth!

While these regulations became effective starting from the date of publication on Friday December 4, 2021 as the first stage. Providing that the implementation in terms of invoices generation will become mandatory for taxpayers, whether for businesses (B2B) or customers (B2C) in two separated levels.

Phase one: December 4, 2021

The new release.

Phase two: January 1, 2023

The integration processes.

Electronic Invoice in Saudi Arabia Classifications

As explained by the Authority, the E-Invoice will be issued in two types:

- Electronic Invoice (Standard Invoice)

- Simplified E-Invoice

Both of them must contain the technical and financial information required.

How QR Codes are used in Electronic Invoices for KSA?

Contents vary from phase one to phase two, as the Authority mentioned:

First Level QR Barcode

for e-invoice systems

Supplier name.

Value Added Tax (VAT) Number.

Date & Time.

Total Cost (Including VAT).

VAT Cost.

Second Level QR Barcode

for e-invoice systems

Supplier name.

Value Added Tax (VAT) Number.

Date & Time.

Total Cost (Including VAT).

VAT Cost.

Invoice Hash encrypted for e-invoice.

Cryptographic stamp.

Public Key.

Digital Signature used in the issuance of electronic invoices.

What are the technical requirements for Electronic Invoices and notifications?

It demands on the suppliers or taxpayers, whether it was Business to Business or Business to Customer!

In case the e-invoice will be used B2C or B2B, the user shall insert the minimum fields required to generate the electronic invoice.

Technical Requirements for the Simplified E-Invoice (B2C)

Requirements |

Phase One |

Phase Two |

|

Electronic Invoices transmission method |

Invoices and related notifications shall be issued from online solution. |

Invoices and related notifications shall be issued from online solution. |

|

E-Invoice Fields |

The minimum required fields shall be applied. |

The minimum required fields shall be applied. |

|

E-Invoice Format |

Any format will be applicable, as long as it will be left in invoices and related notifications. |

Generate invoices with XML or PDF A3 format and to be shared with ZATCA portal. |

|

QR Barcode |

Generated and printed QR Code must be added with the minimum required fields. |

Generated and printed QR Code must be added with the required fields and any additional information. |

|

Cryptographic stamp |

N/A |

Cryptographic stamp will be generated through ZATCA portal. |

|

Invoice Hash |

N/A |

Hash algorithm will be used to encrypt data. |

|

UUID |

N/A |

The solution used must generate UUID for invoices and related notifications. |

|

Tamper-resistant counter |

N/A |

The solution must contain tamper-resistant counter with a serial number. |

|

Prohibited Functions |

|

|

|

E-Invoicing Record Keeping |

Taxable persons must adhere to the record keeping requirements of E-Invoices XML or PDF A3. |

Taxable persons must adhere to the record keeping requirements of E-Invoices XML or PDF A3. |

|

Tamper-proofing mechanisms |

The e-invoice system must have tamper-proofing mechanisms that prevent users from any modification with invoices or the solution itself, with the ability to record and detect any tampering attempts. |

The e-invoice system must have tamper-proofing mechanisms that prevent users from any modification with invoices or the solution itself, with the ability to record and detect any tampering attempts. |

|

Internet Connectivity |

N/A |

The solution must be able to connect to the internet (Example: TLS) |

|

Integrity |

N/A |

Send / Receive Electronic invoices with real-time integration with Zakat and Tax Authority. (Application programming interface API) |

Technical Requirements for the Standard E-Invoice (B2B)

Requirements |

Phase One |

Phase Two |

|

Electronic Invoices transmission method |

Invoices and related notifications shall be issued from online solution. |

Invoices and related notifications shall be issued from online solution. |

|

E-Invoice Fields |

The minimum required fields shall be applied. |

The minimum required fields shall be applied. |

|

E-Invoice Format |

Any format will be applicable, as long as it will be left in invoices and related notifications. |

Generate invoices with XML or PDF A3 format and to be shared with ZATCA portal. |

|

QR Barcode |

Generated and printed QR Code must be added with the minimum required fields. |

Generated and printed QR Code must be added with the required fields and any additional information. |

|

Cryptographic stamp |

N/A |

Cryptographic stamp will be generated through ZATCA portal. |

|

Invoice Hash |

N/A |

Hash algorithm will be used to encrypt data. |

|

UUID |

N/A |

The solution used must generate UUID for invoices and related notifications. |

|

Tamper-resistant counter |

N/A |

The solution must contain tamper-resistant counter with a serial number. |

|

Prohibited Functions |

|

|

|

E-Invoicing Record Keeping |

Taxable persons must adhere to the record keeping requirements of E-Invoices XML or PDF A3. |

Taxable persons must adhere to the record keeping requirements of E-Invoices XML or PDF A3. |

|

Internet Connectivity |

N/A |

The solution must be able to connect to the internet (Example: TLS) |

|

Integrity |

N/A |

Send / Receive Electronic invoices with real-time integration with Zakat and Tax Authority. (Application programming interface API) |

Note: QR Code is mandatory for the B2C invoicing, while the B2B one will be required since the second level begins.

What are electronic invoices solutions for business owners? (B2B)

Standard Electronic invoices are an invoice issued for Business to Business and Business to Government transactions.

Standard e-invoice is shared by the seller to the buyer after being cryptographically stamped by Zakat Authority and contains the fields as per VAT legislations including the seller and buyer information , transaction , services / goods , and technical fields that are mainly generated with trusted electronic invoicing solutions.

Simplified E-invoice Template

B2C Issued Innvoice

E-invoice Template

B2B Issued Innvoice

What are electronic invoices solutions for customers / taxpayers? (B2C)

Simplified Electronic Invoices are an invoice issued for Business to Customers transactions.

Buyers / Customers at the point of sale as example, the receipt will contain a QR Barcode to verify the transaction. Simplified e-invoices are issued and shared with customer and a copy is subsequently archived and stored in the solution used.

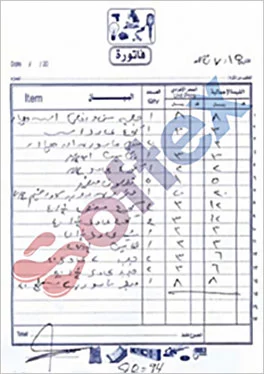

Before

After

What are the penalties , violations and irregularities for non-compliance with the electronic invoices regulations?

The Authority has the rights to levy penalties for noncompliance!

Through the E-Invoice regulations issued by Zakat, Tax and Customs Authority on December 2020.

It has emphasized that the noncompliance to the guidelines related to the electronic archiving (XML / A3) a fine of 5,000 SAR will be signed.

While Vendors / Taxpayers who are not committed to the QR Code, the organization will receive a warning for the first time, after that a fine of 10,000 SAR will be signed.

Why to choose us?

Market Control Online E-Invoice System

Softex Software House is one of the best electronic invoices solution providers, and verified at the Kingdom of Saudi Arabia with a demonstrated history in creating and implementing software solutions all over the Arabian countries.

Since 2004, Softex accomplished more over +2000 successful project all over the world. With a premium service level of agreement and a professional team helping you to acquire , install , manage , and maintain the suitable solution for your business.

The Ability to integrate with Larger Suite

Our Clients